Treasury operations involve various risks that must be evaluated and managed to ensure the security and stability of both businesses and investors.

Effective risk management strategies, such as hedging, diversification, maintaining liquidity reserves, and implementing internal controls, are essential in building the foundation for managing financial risks and minimizing exposure to potential financial losses.

Key risk indicators (KRI) provide a way to assess these risks, allowing managers to either mitigate risks and develop strategies to mitigate them.

KRIs are applicable in treasury operations and other areas, such as finance and banking. They help organizations identify potential threats, enabling them to take proactive measures before an issue arises.

Treasury operations can be a great asset to any business. It provides the flexibility needed to manage finances and capital sources with precision and accuracy. However, treasury operations also have certain risks that must be identified, understood, and managed accordingly.

Knowing these risks is essential to ensure that your company’s treasury operations run smoothly and efficiently. Let’s take a look at some of treasury risks and the key operational risk indicators for treasury operations.

One of the biggest risks inherent in treasury operations is counterparty risk. Counterparty risk is the risk that one of your trading partners will default on their commitments and not fulfill their obligations under the contract. This could seriously affect an organization’s financial health if it does not manage its counterparty credit risk effectively.

To mitigate this risk, organizations should conduct thorough due diligence when selecting counterparty partners, maintain diversified relationships across multiple partners, monitor activities on a regular basis, and engage external experts as needed.

Another major risk associated with treasury operations is liquidity risk—the risk that an organization cannot access sufficient funds to cover current and future liabilities or investments when they become due. This can lead to cash flow issues that can significantly disrupt an organization’s own financial health and stability.

To minimize liquidity risk, organizations should develop a robust cash management process that takes into account both external and internal factors, such as economic conditions, customer demand,

Supplier payments, maintain adequate buffers of liquid assets (such as cash or marketable securities) in case of emergency situations and leverage flexible financing solutions such as revolving credit facilities risk indicator of business units when needed.

MarketRisk Indicators

Market risk refers to potential losses due to market volatility or changing market conditions. Market risk indicators help businesses measure and manage exposure to market movements by considering factors such as industry trends, economic conditions, commodity prices, currency exchange rates, and political events that could affect the value of investments or assets held by a company.

These risks can be managed through diversification strategies such as hedging or diversifying across different asset classes or markets to spread out the potential for losses in any area.

Finally, regulatory compliance is another important factor in managing treasury operations effectively. Many countries have implemented regulations governing the activities of financial institutions, which must be adhered to for organizations to remain compliant with local laws and regulations.

It is important for organizations to understand these regulations and ensure they are up-to-date with all relevant changes so as not to face any penalties or sanctions from regulatory authorities

Additionally, organizations should have policies and procedures in place that are designed specifically to address regulatory requirements such as Know Your Customer (KYC), and Anti-Money Laundering (AML) so that they can remain compliant while also protecting their customers’ data privacy rights at all times.

Providing timely reports to management is an important and burdensome job for the corporation’s Treasury Department. The management report typically combines treasury account results, forecast, and cash positioning information, future funding projections, and a market risk exposure analysis.

The current financial environment has helped risk management strategies the treasury gain greater importance in corporate finances, as senior managers understand the significance of effectively managing transparency in the treasury.

KPIs are critical to the effective management of money within an organization. These data identify specific activities that are present in ordinary operations and can be used by a business owner to monitor cash flow. Identify the strength and weaknesses in your company’s cash flow and prioritize key performance measures.

Accounting and Finance Law

How to use a list of sample key risk indicators for treasury risk management?

Using a list of sample key risk indicators by the treasury department is an effective way to evaluate and manage risks related to treasury operations. Frequent cash flow forecasts are essential to mitigate treasury risk by identifying cash shortages, revealing cash surpluses, and incorporating market risk factors, industry trends, and seasonality indicators for better preparedness. The list should include indicators from different sources, such as financial ratios, liquidity metrics, creditworthiness assessments, and other operational risk measures.

Through understanding the risks a particular business or organization may be exposed to, managers can use the KRIs to develop strategies for mitigating those and mitigating financial risks. Additionally, utilizing key risk indicators provides insight into how well an organization’s current treasury operations are performing and serves as an early warning system for potential issues ahead.

The effectiveness of the KRIs can be improved by improving the risk reported by identifying the underlying cause. To use the list of important risk indicators, you need to start by selecting them and ensuring that they target the cause of the underlying problem you measure.

Tracking your KRI list will enable you to predict failure, so it is possible to prevent the situation from getting worse.

Why should organizations measure Treasury performance?

Measuring Treasury performance is essential for organizations to ensure the effectiveness and efficiency of their treasury operations and maintain financial stability. In using key treasury risk management indicators, many organizations can quickly assess their current financial situation, identify potential risks, and develop strategies to mitigate them.

This helps ensure that decisions made within the organization are based on the most accurate information. Additionally, measuring Treasury performance allows for comparison between different departments or divisions within the organization, allowing for improved interdepartmental collaboration and better overall performance.

If we aren’t monitoring our treasury performance, we are making a decision that is based on our intuition that has historically not been accurate. Treasuries have to focus their attention on components used to calculate KPIs.

Treasury performance

How choosing the right treasury KPIs can help CFOs?

CFOs can quickly identify financial trends and make well-informed decisions based on accurate data. Treasury management plays a crucial role in this process by offering solutions for risk management, cash flow forecasting, payments, liquidity management, and regulatory compliance.

Additionally, choosing the right KPIs(Key performance indicators) enables CFOs to track treasury performance over time and compare it against industry benchmarks. This provides invaluable insight that can be used to create more effective strategies for reducing treasury risk, and improving financial performance.

Treasury key performance metrics are metrics used for measuring the performance of the Treasury. Due to volatile economic conditions and frequent market fluctuations, CFOs must determine appropriate liquidity, funding risk, and corporate governance.

How should you select the right treasury KPIs for your company?

KPIs provide management tools and provide reliable measurement of important business processes. Following the global financial crisis, KPI adoption jumped in corporations’ treasuries. Boards of directors and other stakeholders, such as investors and industry analysts, have increased the need for reliable measures of Treasury activity.

KPIs and the economic situation

The aftermath of the financial crises triggered the adoption of the Treasury KPI. KPI examples listed are some of the key priorities of the corporate sector in measuring and managing money and finance. Experience suggests that economics and market volatility are expected to remain the norm for the foreseeable future.

An extensive array of KPIs related to cash flow management strategies and financial risk management will be required for corporate governance. KPI management software is designed to manage the future demand for specific data types and should provide adequate flexibility.

Who should set treasury KPIs?

In practice, Treasury KPIs can be determined by the Treasury staff as they have expertise in technical disciplines and complex disciplines. All stakeholders need these measurable indicators to support them.

The most likely way of doing this is by surveying the parties involved in determining the priority of measurement of Treasury Activities. It is essential that a group treasurer chooses the KPI set. After a while, they are primarily responsible for implementing KPIs and generating management reports.

Selecting KPIs

It is crucial that a treasury KPI is developed as a practical measure for delivering results. A treasury’s best profitability metric depends on many factors, including its economic nature and business structure, corporate leverage, and excess.

Similarly, a highly leveraged domestic utility company requires quite different types of KPIs than an economically able exporter, which has an enormous amount of foreign currency income.

Strategic versus tactical Treasury KPIs

The KPIs have three categories – strategic – tactical – operational. Strategic KPIs are concerned with determining progress toward the desired endpoint. A strategic KPI measures treasury contribution and performance at new or achieved targets within a defined objective based on the treasury.

Percentage of non-interest bearing cash vs. total cash

These ratios consider the noninterest-bearing balance of accounts compared with the total balance. Noninterest cash is issued in cash and represents liabilities representing payments from an entity or third party. This will be cash transactions reconciled automatically and investment management KPIs

Total amount of money owed to noninterest-bearing accounts/total assets owed.

Percentage of daily cash balances vs. forecasts to manage cash flows

Calculating daily money balance percentages versus your forecast helps you determine whether the forecast will work out for the period you planned for. Period. The data can help you find discrepancies in your cash flow forecasting.

Formula: The daily cash balance/forecast total cash balance.

Percentage of payments made on time

Similar to late charges, there must be stricter measures to prevent them. If your business continues to be late for payment, this can provide you with an alert to enhance communication.

formula _ 1 = = Total payment amount paid on time v/ Total payment quantity = =

Percentage of restricted cash vs. total cash as a measure of liquidity risk

Understanding the number of restricted funds you have is crucial to ensuring that you have the right amount of cash in place. The excess of cash could cause unreliable and liquidity risks. Formulas. Total limitable cash or the total amount of money.

Accuracy of Forecasted Investment Income

Unlike cash forecasts, KPIs forecast interest rates and costs that are comparable to actual costs.

Form: Actual interest charges (minus forecast interest costs) and forecast interest expenses.

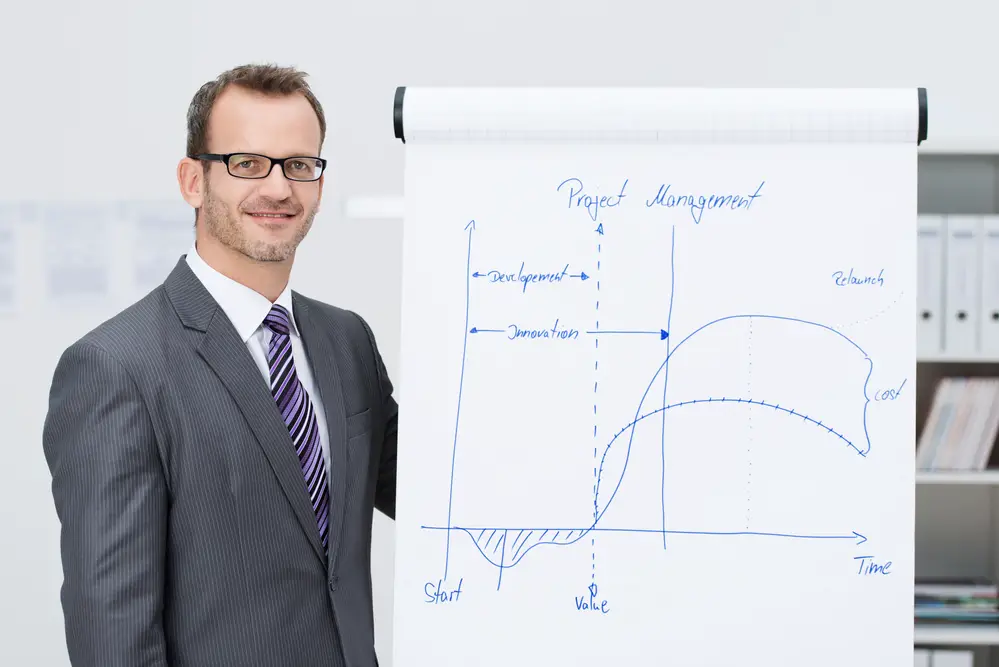

flipchart with an analytical graph

Percentage of payments containing errors

To improve payment processing accuracy and quality, it’s important to find the number of payments that contain errors.

Form: Payment amount includes errors/payment totals.

Accuracy of cash forecasts

A KPI can accurately track a future cash flows financial forecast if the forecast is correct. Forecasted and expected cash balances.

Error rate KPIs

Error rate KPIs measure accuracy in cash flows over time and can be used to forecast, pay or invest.

Credit line providers, cash reserves, operational and financial risks themselves, and financial obligations are all factors that must be taken into account when managing a Treasury department.

Credit line providers can provide access to reliable funding, while cash reserves help organizations manage short-term liquidity needs.

Operational risks are important to consider when assessing potential investments or activities, and financial obligations must be monitored to ensure that all payments are made on time. By keeping a close eye on these factors, companies can ensure that their cash visibility treasury operations are being managed effectively and efficiently.

Conclusion

As you can see, there are many key indicators for managing treasury operations successfully by minimizing risks associated with them, including: risk mitigation counterparty risk, liquidity risk, and regulatory compliance requirements.

Understanding these risks before entering into any transactions or contracts with other parties will help ensure that your organization remains financially secure while taking advantage of opportunities available through the effective use of treasury and risk management techniques.

We understand how important it is for businesses today to stay ahead of potential credit risks from within their treasuries – contact us today to find out how we can help you do just that!

Chris Ekai is a Risk Management expert with over 10 years of experience in the field. He has a Master’s(MSc) degree in Risk Management from University of Portsmouth and is a CPA and Finance professional. He currently works as a Content Manager at Risk Publishing, writing about Enterprise Risk Management, Business Continuity Management and Project Management.