Credit risk is the potential for borrowers to default on their loans or fail to make timely payments, which could result in bank losses. Banks need robust risk management strategies to manage credit risk effectively, including using key credit risk indicators (KRIs).

KRIs are metrics used by banks to monitor and measure potential risks associated with lending activities. These indicators provide early warning signs of possible credit risks and enable banks to mitigate such risks proactively.

KRIs can be divided into different categories, including quantitative KRIs involving numerical data analysis, operational and market risk metrics focusing on non-lending activities and credit risk metrics specifically relating to loan delinquencies and non-performing loans.

This article will explore the concept of key credit risk indicators in depth and how they can be used as effective tools for managing credit risks in the banking industry.

Key Credit Risk Indicators examples

Non-Performing Loans Ratio (NPL Ratio): This KRI measures the proportion of a bank’s non-performing loan portfolio, i.e., in default or close to being in default. A high NPL ratio can indicate a high level of credit risk.

Loan to Value (LTV) Ratio: This KRI measures the ratio of a loan to the value of the asset purchased with the loan. A high LTV ratio can indicate a high level of credit risk, as it suggests that the borrower has a small equity cushion, which increases the likelihood of default.

Credit Utilization Ratio: This KRI measures the amount of credit a borrower uses relative to their credit limit. A high credit utilization ratio can indicate a high level of credit risk, as it suggests that the borrower may be overextended.

Delinquency Rates: This KRI measures the proportion of past due loans but not yet in default. A high delinquency rate can indicate a high level of credit risk.

Credit Concentration: This KRI measures the extent to which a bank’s loan portfolio is concentrated in particular sectors, geographic areas, or types of borrowers. High credit concentration can indicate a high level of credit risk, as it suggests that the bank is heavily exposed to the fortunes of a particular sector, area, or type of borrower.

Changes in Credit Ratings: This KRI measures changes in the credit ratings of a bank’s borrowers. Downgrades in credit ratings can indicate an increasing level of credit risk.

Loan Loss Provision to Total Loans Ratio: This KRI measures the proportion of a bank’s total loans set aside as provisions for potential loan losses. A high ratio can indicate a high level of credit risk, as it suggests that the bank expects a significant proportion of its loans to go bad.

Credit Risk Metrics

Loan delinquencies refer to payments overdue by at least 30 days, while non-performing loans are those where the borrower has failed to make payments for a period of 90 days or more. These metrics provide insight into the creditworthiness of borrowers and allow banks to assess their overall portfolio risk.

Banks closely monitor loan delinquencies and non-performing loans through key credit risk indicators (KRIs). KRIs provide early warning signs of potential risks that could affect a bank’s ability to succeed.

Tracking these metrics, banks can identify trends in borrower behavior and take proactive measures to mitigate potential losses. This may include restructuring loan terms or taking legal action against defaulters.

Moreover, KRIs also play an important role in banks’ regulatory compliance and reporting requirements. Regulators often require banks to monitor and report on their operations, including credit risk management.

Utilizing KRIs, banks can demonstrate their adherence to regulatory standards and maintain transparency with stakeholders such as shareholders and customers.

Operational Risk Metrics

Operational risk metrics are crucial for banks to monitor the adequacy and effectiveness of their internal systems, controls, procedures, and policies in mitigating potential losses arising from operational failures.

Operational risks can arise due to inadequate internal controls or fraud, external events such as cyber-attacks or natural disasters, or process failures.

As such, it is necessary for banks to employ appropriate operational risk metrics that help identify potential vulnerabilities and allow for timely intervention.

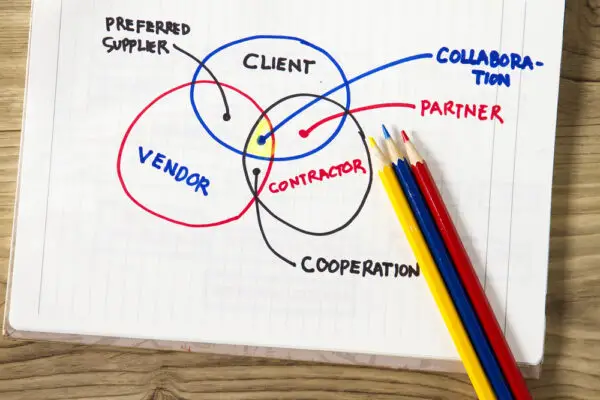

Some of the key operational risk metrics that banks use include cybersecurity threats, third-party relationships, internal fraud, external fraud, and business interruption. These metrics help banks assess their exposure to different risks and determine whether they have adequate measures to mitigate them.

For instance, monitoring cybersecurity threats helps banks ensure that they have appropriate security protocols to safeguard customer data. Similarly, tracking third-party relationships helps banks evaluate vendor performance against contractual obligations.

Operational risk metrics are vital in helping banks manage their exposure to various forms of operational risks. By employing these metrics effectively, banks can identify potential vulnerabilities early on and take corrective action before significant losses occur.

Market Risk Metrics

Market risk metrics give banks crucial insights into the external factors that may affect their financial position and ability to operate effectively in the current market.

Market KRIs are used to assess potential losses from changes in exchange rates, interest rates, equity prices, and commodity prices. Identifying and monitoring market risks can help banks adjust their strategies to mitigate losses from unexpected events.

One of the most important markets, KRIs, is valued at risk (VaR), which measures the maximum potential loss within a specified time frame for a given confidence level.

VaR helps banks quantify the capital they need as a buffer against market fluctuations. Other quantitative market KRIs include tracking error, beta, duration gap, and option-adjusted spread.

In addition to quantitative metrics, qualitative market KRIs, such as geopolitical events and regulatory changes, can significantly impact a bank’s operations. Banks must continually monitor these factors and be prepared to adjust their strategies accordingly.

Leveraging advanced risk management tools like ZenGRC’s enterprise risk management software, banks can gain real-time insights into their exposure to different types of risks and develop effective mitigation plans to protect themselves against potential losses.

Quantitative KRIs

Quantitative KRIs provide banks with measurable metrics that can be used to monitor various aspects of their operations and identify potential areas of risk. These KRIs are based on numerical data and can be expressed as a percentage, ratio, or absolute value.

They enable banks to track performance against established targets and benchmarks, detect trends over time, and compare performance across different business units.

Quantitative KRIs are particularly important for credit risk management in banks. Key credit risk indicators help to evaluate the likelihood of borrowers defaulting on loans or failing to meet their contractual obligations.

Examples of quantitative KRIs for credit risk include the number of delinquent loans, non-performing loan ratio, loan-to-value ratio, debt service coverage ratio, and net interest margin.

Quantitative KRIs provide valuable insights into the financial health of a bank’s loan portfolio. By tracking these metrics regularly, banks can identify emerging risks early on and take appropriate actions to mitigate them.

Additionally, regulators may require banks to report on certain key credit risk indicators as part of their supervisory activities. Therefore, it is crucial for banks to have robust systems in place for collecting, analyzing, and reporting quantitative KRIs related to credit risk management.

Risk Management Tools

Risk management in the banking sector can be enhanced through various tools and technologies that enable banks to identify, assess, monitor, and mitigate risks across their operations.

One such tool is ZenGRC’s enterprise risk management software, which delivers real-time threat detection. This software provides an integrated approach to risk management that enables banks to automate workflows, assign tasks, and monitor progress toward achieving their risk mitigation objectives.

Another way that banks can utilize technology to enhance their risk management efforts is by using risk assessment tools that help assess data controls to ensure they meet industry requirements. For example, ZenGRC’s platform allows organizations to perform a gap analysis between current practices and those required by regulations or standards such as PCI DSS or ISO 27001.

Banking institutions can use ZenGRC’s risk management platform for building business continuity plans and a robust risk framework while documenting all relevant activities related to mitigating risks.

This documentation helps provide transparency into how the bank manages its risks and ensures accountability among stakeholders responsible for managing them.

In conclusion, utilizing technology such as ZenGRC’s platform enables banks to improve their overall risk management processes by streamlining workflows and providing visibility into potential threats.

Frequently Asked Questions

How do banks use key credit risk indicators to assess the creditworthiness of their borrowers?

Banks use key credit risk indicators to assess the creditworthiness of their borrowers by monitoring loan delinquencies and non-performing loans. These KRIs are early warning signs of potential default, allowing banks to develop risk mitigation plans and ensure regulatory compliance.

Can operational risk metrics help banks identify potential cybersecurity threats before they occur?

Operational risk metrics can assist banks in identifying potential cybersecurity threats before they happen. These metrics monitor the adequacy and failure of internal systems, controls, procedures, or policies to detect risks that could impact the bank’s ability to succeed.

What are some of the key market risk metrics that banks track to stay ahead of market fluctuations?

Banks track various quantitative key risk indicators (KRIs) to stay ahead of market fluctuations. Examples include value at risk, budget variance, and a number of deviations from Generally Accepted Accounting Principles, which help analyze significant challenges affecting the current market.

How do quantitative KRIs differ from other risk indicators, and how can they be used to measure risk objectively?

Quantitative KRIs are objective metrics that measure risk numerically, allowing for data-driven decision-making.

They differ from other types of KRIs by providing a measurable and analytical approach to identifying potential risks, enabling banks to develop effective risk mitigation plans.

What specific risk management tools and strategies can banks use to mitigate the impact of potential risks and prevent financial losses?

Banks can implement various risk management tools and strategies to mitigate risks and prevent financial losses.

These may include developing business continuity plans, documenting risk mitigation activities, performing gap analyses, using real-time threat detection software, and assessing data controls to ensure compliance with industry requirements.

Conclusion

Key credit risk indicators (KRIs) are essential for banks to manage their exposure to credit risks. By identifying potential risks through KRIs, such as loan delinquencies and non-performing loans, banks can take proactive measures to mitigate these risks and ensure their financial stability.

Effective risk management strategies are critical for the success of banks in today’s complex financial environment. In addition to credit risk metrics, operational and market risk metrics should be considered when developing comprehensive risk management plans.

Quantitative KRIs can provide valuable insights into the level of risk exposure banks face, enabling them to make informed decisions on managing these risks. With these tools, banks can remain resilient even during economic uncertainty and continue to provide value to their stakeholders.

Chris Ekai is a Risk Management expert with over 10 years of experience in the field. He has a Master’s(MSc) degree in Risk Management from University of Portsmouth and is a CPA and Finance professional. He currently works as a Content Manager at Risk Publishing, writing about Enterprise Risk Management, Business Continuity Management and Project Management.