Enterprise Risk Management (ERM) is critical to any successful business. ERM involves the identification, analysis, and management of risks that could have an impact on the organization. Most organizations have an erm program that monitors the performance of risk exposure.

Understanding Key Risk Indicators (KRIs) ensures risk is properly identified and managed. KRIs are metrics used to measure and evaluate risk-related information so that organizations can best manage their risks.

Developing key risk indicators of significant risks, especially for operational risk management, is crucial for risk managers. Depends on the risk appetite of the organization.

Are you ready to take control of your organization’s risk? Enterprise Risk Management (ERM) is all about proactively addressing the risks your business may face and taking steps to protect against their negative impacts.

The most effective ERM processes actively identify, assess and monitor potential risks from various areas, including financial performance, operational efficiency, customer relationships, and technology threats.

While you can achieve a robust enterprise risk management framework for your organization in many ways, one critical strategy is setting up key risk indicators that provide crucial insights into any potentially risky activities or environments within your business landscape.

Read on to learn more about creating an effective Key Risk Indicators (KRI) program and how this vital part of ERM can help keep your organization safe.

Examples of Enterprise Risk Management Key risk indicators

Organizations should develop KRIs based on their specific needs and objectives. This includes understanding the types of risks they face, identifying potential indicators for each type of risk, and developing appropriate thresholds for each KRI.

Key Risk Indicators are essential tools for Enterprise Risk Management (ERM). They provide an effective way to measure and monitor risks so organizations can take proactive steps to mitigate them before they become major issues.

a)Number of systemic risks identified

Systemic risk can be defined as the potential for a single event or series of events to cause severe instability or collapse in an entire industry or economy. Identifying and understanding the number of systemic risks that may affect an enterprise is important, as this can help inform decisions about how best to manage risk.

When assessing systemic risks, it is important to consider both cross-sectional and time-based risks. Cross-sectional risks refer to the potential for a single event or series of events to cause instability across multiple sectors, while time-based risks refer to the potential for a single event or series of events to cause instability over a longer period of time.

In addition, it is important to consider emerging systemic risks that may not have been identified previously. These could include natural disasters, technological accidents, pandemics, cyberattacks and other unforeseen events that could have significant impacts on an enterprise’s operations.

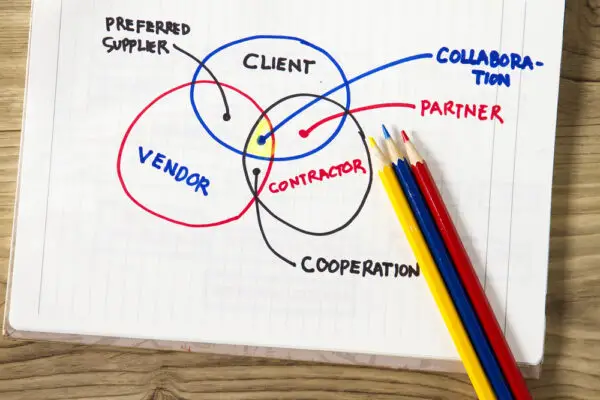

ERM has a crossfunctional nature; it is not feasible to carry out this in a silos. Business can consist of parts. It applies to the risks. Risk events in the business also impact other functions of the company.

Process owners take risks; risk is managed; Ensure that information is complete and accurate. The greater the involvement of process owners in risks analysis, the more information collected.

b)Percentage of process areas involved in risk assessments

This metric helps ensure that ERM is cross-functional and not performed in silos.

The five steps to risk assessment are: understanding the hazard or risk; identifying who may be harmed; evaluating the risks and deciding on precautions; recording your findings; and reviewing your assessment.

A competent person should undertake each step to ensure accuracy. The level of detail in the risk assessment should be appropriate for the identified hazard or risk.

When conducting a risk assessment, it’s important to involve workers or their representatives so they can provide insight into potential hazards or risks. Additionally, it’s important to consider all factors that could lead to harm, such as people, processes, situations and environment.

Once all factors have been identified, they should be evaluated based on their likelihood and severity of harm if left unaddressed. This will help determine which areas need more attention when creating control measures.

Organizations can ensure that all potential hazards are identified and addressed appropriately by tracking the percentage of process areas involved in risk assessments as a key risk indicator for ERM. This will help reduce the likelihood of harm occurring due to negligence or oversight.

c)Percentage of key risks monitored

One of the most important metrics for measuring risk is the percentage of key risks monitored. This metric helps organizations determine how well they are monitoring their risks and whether or not they need to increase their efforts. Organizations should strive to monitor a high percentage of key risks, as this will help them identify potential threats before they become major issues.

Organizations should also differentiate between Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs). While both measure performance, KRIs measure potential risks, while KPIs measure performance against goals.

It is important for organizations to understand the difference between these two types of indicators so that they can effectively manage their risks.

d)KPIs for assessing risks for a business

Some common KPIs for risk management include time to resolution, regulatory compliance rate, audit findings rate, incident severity levels, and cost of risk mitigation.

These KPIs help organizations identify areas where they need to improve their risk management processes and strategies. They also provide valuable information on how well the organization manages its risks.

e)Percentage Of Key Risks Mitigated

A sense of the risk cover for your company is important. Since all risk assessment must use standard criteria, you can determine an equal level of tolerance across an organization based on the result assessment index.

It is possible to prioritize resource allocations to risk that require more coverage rather than wasting them with lower impact. This gap analysis is also helpful for the identification of emerging risks as they fall outside of the tolerance threshold.

What Is the Purpose of Key Risk Indicators?

In addition, KRI plays a critical risk management function in the operational risks management process. The KRI predicts risks especially in highly risky regions or industry sectors. KRIs provide a sophisticated warning that lets companies prepare for risk.

Examples of KRIs

KRIs can be used to determine people / processes and facilities critical to the operation or management of a business unit. KRI also gives measurements that, if exceeded, can cause business disruption. The table below presents an overview of KRIS for different aspects of business and sample measurement.

| Aspect of Business | Sample Measurement |

| Financial Performance | Profitability ratios, growth rates, operating cash flow. |

| Human Resources | Turnover rates, employee satisfaction levels, absenteeism. |

| Compliance | Regulatory issues and non-compliance fines. |

| Customer Service | Customer complaints volumes, customer retention rates. |

| Technology | Operational uptime and performance of IT systems. |

KRIs provide an early warning system that can help organizations identify and monitor risks, allowing them to take proactive steps to mitigate potential losses. KRIs are developed in relation to an organization’s people, processes, technology, facilities and other elements critical to its operations.

Organizations can develop KRIs based on their specific needs and objectives. For example, a financial institution may develop a KRI related to credit risk that monitors changes in the levels of non-performing loans or loan delinquencies.

A manufacturing company may develop a KRI related to operational risk that monitors changes in production efficiency or quality control measures. An information technology company may develop a KRI related to cyber security that monitors changes in the number of successful cyber attacks or data breaches.

In addition, organizations should consider developing KRIs for strategic objectives such as customer satisfaction or market share growth. By monitoring these indicators closely, organizations can quickly identify any potential risks that could impede progress towards their goals.

Overall, Key Risk Indicators are invaluable for proactively managing risks and helping organizations achieve their strategic objectives.

How to Leverage Key Risk Indicators for Enterprise Risk Management

Key risk indicators (KRIs) are essential to enterprise risk management (ERM). KRIs help businesses identify, assess, and monitor risks that could significantly impact their operations.

By leveraging KRIs for risk exposures, businesses can identify potential problems early on and take preventative measures before the risks become unmanageable.

Why Use KRIs?

The use of KRIs in ERM provides multiple benefits for organizations. First, they provide valuable insight into organizational performance and allow organizations to quickly identify potential areas of risk before they become major issues.

Second, they help organizations prioritize their resources by allowing them to focus on areas where action must be taken to reduce risk exposure. Finally, they enable organizations to set measurable goals for risk management efforts so that progress can be monitored over time.

Conclusion

The use of KRIs in ERM is essential for any organization looking to improve its overall performance and reduce its exposure to potential risks. Risk Managers develop key risk indicators providing insight into organizational performance and helping organizations prioritize their resources.

KRIs offer valuable metrics for measuring success when it comes to managing organizational risks. With the right metrics in place, organizations can ensure that their efforts towards managing risks are yielding positive results over time.

Key risk indicators are an invaluable tool for enterprise risk management strategies. By leveraging them effectively, businesses can proactively identify and manage any potential risks before they become too large or unmanageable.

Of course, it’s important to remember that there is no one-size-fits-all approach here; each business should tailor its own KRIs based on its unique needs and goals. With proper planning and execution, however, businesses can make sure that their ERM efforts suceed.

Chris Ekai is a Risk Management expert with over 10 years of experience in the field. He has a Master’s(MSc) degree in Risk Management from University of Portsmouth and is a CPA and Finance professional. He currently works as a Content Manager at Risk Publishing, writing about Enterprise Risk Management, Business Continuity Management and Project Management.